What Is Dollar-Cost Averaging, and How Does It Work?

Imagine you’re at a farmer’s market every week. You have $20 to spend on apples, but the price per apple fluctuates depending on the season. Some weeks, apples are expensive, and you get fewer. Other weeks, they’re cheaper, and you can buy more. Over time, you’ve likely averaged out the cost per apple while steadily building your collection.

This is Dollar-Cost Averaging (DCA) in action—a methodical, disciplined approach to investing that helps you manage market volatility and potentially smooth out your investment returns over time.

In my experience as a CERTIFIED FINANCIAL PLANNER™ professional, I’ve found that DCA is one of the most straightforward yet effective strategies for building wealth. Investors I’ve worked with appreciate its simplicity, and I recommend it especially for those who want to stay invested without getting caught up in market timing.

By the end of this article, you’ll learn:

- How dollar-cost averaging works and its key benefits.

- Common misconceptions about the strategy.

- Practical ways to implement DCA in your financial plan.

Why Listen to Me?

As someone who has worked with clients through various market cycles, I’ve seen firsthand how emotional investing can derail even the best financial plans. My approach has always been to simplify the process for investors and focus on strategies that align with their goals.

Dollar-cost averaging is one of those strategies. It’s not just a technique—it’s a mindset that helps you stay consistent, even when markets get choppy. Investors often tell me they appreciate how I break down complex concepts into actionable steps, and that’s exactly what I’ll do here.

👉 How would it feel to know exactly when you can retire and how much you can spend without running out of money? Let’s talk. In a complimentary call, I’ll walk you through your numbers and show you strategies that could help you retire with more confidence and less stress. Schedule Your Call

Key Takeaways

• DCA reduces emotional decision-making by spreading investments over time.

• It works particularly well for volatile markets, helping to lower the average cost of investments.

• The strategy is simple, scalable, and accessible to investors at all levels.

What Is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) involves investing a fixed amount of money into a specific investment at regular intervals, regardless of the asset’s price. It’s like taking small, consistent steps up a mountain rather than trying to sprint to the top.

How It Works:

- Fixed Investment: You decide how much to invest (e.g., $500/month).

- Regular Intervals: Invest that amount on a set schedule, such as monthly or biweekly.

- Market Impact: When prices are high, you buy fewer shares; when prices are low, you buy more.

The Benefits of Dollar-Cost Averaging

In my experience, emotional investing often leads to poor timing—buying high and selling low. DCA takes emotions out of the equation by sticking to a disciplined plan.

Whether you’re just starting or a seasoned investor, DCA is easy to implement. It’s particularly helpful for those without a large lump sum to invest all at once.

I’ve found that investors who use DCA in volatile markets benefit from buying more shares when prices drop, lowering their average cost over time.

👉How would it feel to know exactly when you can retire and how much you can spend without running out of money? Let’s talk. In a complimentary call, I’ll walk you through your numbers and show you strategies that could help you retire with more confidence and less stress. Schedule Your Call

Common Misconceptions About DCA

While DCA can help lower the average cost of investments, it doesn’t guarantee higher returns. Its primary value lies in reducing risk and emotional errors.

In my experience, even experienced investors benefit from DCA, especially when navigating uncertain markets.

DCA is highly effective for volatile markets but may not maximize returns in steadily rising markets. For such conditions, lump-sum investing might be more appropriate.

How to Implement Dollar-Cost Averaging

Determine how much you can afford to invest regularly. Investors I’ve worked with often start with a small amount and gradually increase it over time.

DCA works best with diversified assets like index funds, ETFs, or stocks. I recommend focusing on investments aligned with your long-term goals.

Automating your contributions ensures consistency. Many brokerage platforms offer automatic investment plans that make DCA effortless.

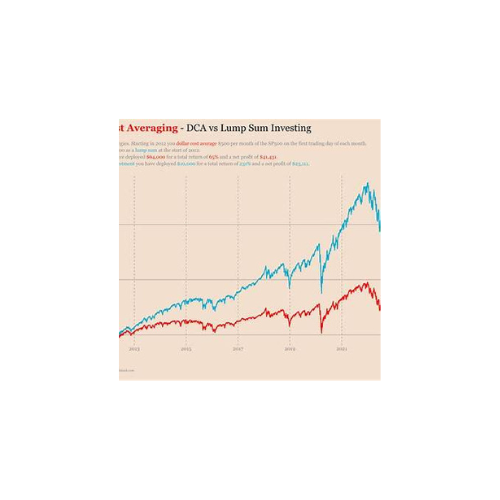

DCA vs. Lump-Sum Investing

In my experience, one of the biggest questions investors ask is: Should I use DCA or invest a lump sum? Here’s how they compare:

• Reduces emotional investing.

• Spreads out risk over time.

• Ideal for volatile markets.

Cons of DCA:

• May miss out on potential gains in rising markets.

• Requires consistent cash flow.

Pros of Lump-Sum Investing:

• Potentially higher returns in upward-trending markets.

• Simpler to execute.

Cons of Lump-Sum Investing:

• Exposes the entire investment to market risk at once.

👉 How would it feel to know exactly when you can retire and how much you can spend without running out of money? Kind of crazy that you just found this blog… and your next step might be booking a complimentary call. In that call, we’ll explore your numbers and see what’s truly possible for you. Schedule Your Call

Real-Life Example

Let’s say you invest $500 every month into an index fund.

• Month 1: Price = $50/share → You buy 10 shares.

• Month 2: Price = $40/share → You buy 12.5 shares.

• Month 3: Price = $60/share → You buy 8.33 shares.

By the end of three months, you’ve invested $1,500 and purchased 30.83 shares. Your average cost per share is $48.65, even though the share price fluctuated between $40 and $60.

FAQs

What are the risks of dollar-cost averaging?

- DCA reduces timing risk but doesn’t eliminate market risk. It’s important to invest in assets aligned with your goals and risk tolerance.

Does DCA work in all market conditions?

- DCA works best in volatile markets. In steadily rising markets, lump-sum investing may yield better returns.

How do I know if DCA is right for me?

- In my experience, DCA is a great fit for investors who value consistency and want to stay invested without worrying about market timing.

Conclusion

Dollar-cost averaging is more than just a strategy—it’s a mindset that prioritizes consistency and discipline over chasing quick wins. In my experience, investors who use DCA feel more confident and less anxious about market swings, making it easier to stick to their long-term goals.

Sources:

https://www.investopedia.com/terms/d/dollarcostaveraging.asp

https://www.investing.com/academy/trading/dollar-cost-averaging/

https://www.experian.com/blogs/ask-experian/pros-cons-of-dollar-cost-averaging/

https://www.fidelity.com/learning-center/trading-investing/dollar-cost-averaging

https://www.investopedia.com/articles/forex/052815/pros-cons-dollar-cost-averaging.asp

https://www.navyfederal.org/makingcents/investing/dollar-cost-averaging.html

https://www.schwab.com/learn/story/what-is-dollar-cost-averaging

https://www.finra.org/investors/insights/dollar-cost-averaging

https://www.td.com/ca/en/investing/direct-investing/articles/dollar-cost-averaging

https://corporatefinanceinstitute.com/resources/wealth-management/dollar-cost-averaging-dca/

Disclaimer: Case studies are hypothetical and do not relate to an actual client of Lock Wealth Management. Clients or potential clients should not interpret any part of the content as a guarantee of achieving similar results or satisfaction if they engage Lock Wealth Management for investment advisory services.