The Basics of Stock, Bond, ETF, Mutual Fund, and Private Markets Investing

Why Understanding Investment Basics Matters (And Why You Should Listen to Me)

Investing can feel overwhelming, especially with so many options—stocks, bonds, ETFs, mutual funds, and private markets. Each investment type serves a unique purpose in building wealth, but understanding the basics is crucial to making informed decisions.

I’m Ben Loughery, CFP®, and I’ve helped individuals and families navigate these investment vehicles to align with their financial goals. In my experience, breaking things down simply allows investors to feel confident and take control of their financial futures.

In this article, I’ll guide you through the history, purpose, and benefits of each type of investment, so you can better understand which might be right for you.

👉How would it feel to know exactly when you can retire and how much you can spend without running out of money? Let’s talk. In a complimentary call, I’ll walk you through your numbers and show you strategies that could help you retire with more confidence and less stress. Schedule Your Call

What You’ll Learn in This Article

• A brief history of stocks, bonds, ETFs, mutual funds, and private markets.

• Key differences, benefits, and drawbacks of each investment type.

• Strategies for combining these investments in a diversified portfolio.

By the end, you’ll have a foundational understanding of these investment tools and how they can help you achieve your goals.

Stocks: Ownership in a Company

Stocks, also known as equities, represent ownership in a company. When you buy a stock, you become a shareholder, owning a small piece of the business.

A Brief History

The first stock exchange was the Amsterdam Stock Exchange, established in 1602 by the Dutch East India Company. Stocks allowed businesses to raise money from investors while providing an opportunity for individuals to share in the profits.

Pros and Cons of Stocks

Pros:

- High Growth Potential: Historically, stocks offer the highest returns compared to other investments.

- Liquidity: Easy to buy and sell on public exchanges.

Cons:

- Volatility: Prices can fluctuate significantly.

- Risk: Higher potential for loss compared to bonds or funds.

👉 Source: History of Stock Exchanges – Investopedia

Bonds: Lending Your Money

Bonds are essentially loans. When you buy a bond, you’re lending money to an organization (e.g., government, corporation) in exchange for periodic interest payments and the return of your principal at maturity.

A Brief History

Bonds date back to Ancient Mesopotamia, but modern government bonds became prominent during the 17th century to fund wars and infrastructure projects.

Pros and Cons of Bonds

Pros:

- Stability: Lower risk than stocks, ideal for conservative investors.

- Income: Provides regular interest payments.

Cons:

- Lower Returns: Bonds typically earn less than stocks over the long term.

- Interest Rate Sensitivity: Rising interest rates can decrease bond prices.

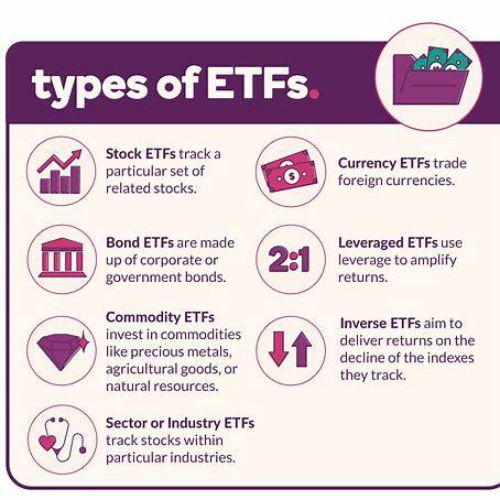

ETFs: The Best of Both Worlds

Exchange-Traded Funds (ETFs) are collections of investments—like stocks or bonds—designed to track an index or sector. Unlike mutual funds, ETFs trade on stock exchanges like individual stocks.

Here is an article where I was quoted on this from Financial Planning

A Brief History

The first ETF, the SPDR S&P 500 ETF, launched in 1993. Since then, ETFs have revolutionized investing with their low costs and flexibility.

Pros and Cons of ETFs

Pros:

- Diversification: Invest in many assets with a single purchase.

- Low Costs: Expense ratios are typically lower than mutual funds.

- Liquidity: Tradeable throughout the day like a stock.

- Market Risk: ETFs still face the same risks as the assets they hold.

- Complexity: Leveraged or niche ETFs can confuse inexperienced investors.

👉 Source: Morningstar on ETFs

Mutual Funds: Pooled Investment Power

Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other assets. They are professionally managed, making them an accessible option for beginners.

A Brief History

The first modern mutual fund, Massachusetts Investors Trust, was launched in 1924. It democratized investing by making diversification affordable for everyday investors.

Pros and Cons of Mutual Funds

Pros:

- Professional Management: Ideal for those who prefer a hands-off approach.

- Diversification: Reduces risk by spreading investments across many assets.

Cons:

- Higher Fees: Management and administrative costs can erode returns.

- Less Control: Investors cannot choose specific holdings.

Private Markets: Investing Beyond the Public Eye

Private markets include investments in companies, real estate, or funds that are not traded on public exchanges. These investments are often limited to accredited investors or institutions.

A Brief History

Private equity and venture capital surged in the 1980s as institutional investors sought high returns in exchange for illiquidity.

Pros and Cons of Private Markets

Cons:

• High Minimums: Often require significant upfront capital.

How to Combine These Investments in a Portfolio

A well-diversified portfolio often includes a mix of:

- Stocks: For growth.

- Bonds: For stability and income.

- ETFs: For diversification at a low cost.

- Mutual Funds: For access to professional management.

- Private Markets: For high-risk, high-reward opportunities (if applicable).

In My Experience: I’ve worked with clients who saw significant success by starting with ETFs and bonds, then gradually adding private investments as their portfolios grew.

FAQs

Should I Start with Stocks or ETFs?

- For beginners, ETFs are a great starting point due to their diversification and lower risk.

Are Private Markets Too Risky?

- They can be, but with proper due diligence and as part of a diversified strategy, they offer unique growth opportunities.

How Do Mutual Funds Differ from ETFs?

- Mutual funds are actively managed and trade at the end-of-day prices, while ETFs are passively managed and trade throughout the day.

Conclusion: Your Investment Journey Starts Here

Understanding the basics of stocks, bonds, ETFs, mutual funds, and private markets is the first step toward building wealth. Each investment type serves a purpose, and the right mix depends on your goals, timeline, and risk tolerance.

In my experience, investors who take the time to learn these fundamentals feel more confident and achieve better results.

👉 How would it feel to know exactly when you can retire and how much you can spend without running out of money? Kind of crazy that you just found this blog… and your next step might be booking a complimentary call. In that call, we’ll explore your numbers and see what’s truly possible for you. Schedule Your Call

Sources:

👉Here is an article I was quoted in regarding my take on a MAGA 7 ETF

https://www.schwab.com/learn/story/stock-investment-tips-beginners

https://www.ubs.com/ch/en/wealth-management/womens-wealth/magazine/articles/private-market.html

https://www.bankrate.com/investing/stock-market-basics-for-beginners/

https://www.blackrock.com/se/individual/themes/discovering-private-markets

https://www.investopedia.com/articles/basics/11/3-s-simple-investing.asp

https://p2pmarketdata.com/articles/private-markets/

https://www.investopedia.com/articles/basics/06/invest1000.asp

https://hamiltonlane.maglr.com/a-guide-to-private-markets/what-are-the-private-markets

https://dfi.wa.gov/financial-education/information/basics-investing-stocks

https://www.nerdwallet.com/article/investing/how-to-invest-in-stocks

Here is an article I was quoted in by Barrons as it relates to ESG investing. Ultimately, my main goal is for you to achieve the best long term outcome and if ESG is a value that you have, we can explore implementing different strategies in your portfolio around this theme.

Here is another article in relation to private markets in the ETF wrapper where I was quoted

Disclaimer: Case studies are hypothetical and do not relate to an actual client of Lock Wealth Management. Clients or potential clients should not interpret any part of the content as a guarantee of achieving similar results or satisfaction if they engage Lock Wealth Management for investment advisory services.