Navigating Required Minimum Distributions (RMDs) in Retirement

Required Minimum Distributions (RMDs) are an important but often misunderstood part of retirement planning. If you’re approaching the age when you need to start taking distributions from your retirement accounts, understanding how RMDs work—and the strategies to navigate them—can help you minimize taxes and make the most of your savings.

In my experience, many retirees are surprised by the impact RMDs have on their taxable income and long-term financial plans. I’ve found that with thoughtful planning, you can align your RMD strategy with your overall goals, whether that’s reducing taxes, preserving wealth, or maximizing charitable giving.

By the end of this article, you’ll understand:

• What RMDs are and why they’re required.

• How to calculate and take RMDs.

• Strategies to manage the tax impact, including Qualified Charitable Distributions (QCDs).

• Whether you can take RMDs from one account or must withdraw from multiple accounts.

Why Listen to Me?

As a CERTIFIED FINANCIAL PLANNER™ professional, I’ve guided countless clients through the complexities of RMDs. Investors I’ve worked with often say they appreciate my ability to help them navigate these mandatory withdrawals while aligning them with their broader financial goals.

👉 Want to learn how to retire without the worry of running out of money in retirement? Click here to watch this video

Key Takeaways

• RMDs are mandatory withdrawals from tax-deferred retirement accounts, starting at age 73 (or age 70½ if you turned 70½ before 2020).

• You can calculate your RMD using the IRS Uniform Lifetime Table.

• Qualified Charitable Distributions (QCDs) allow you to donate your RMD directly to a charity, reducing your taxable income.

• You can take RMDs from a single account or spread them across multiple accounts, depending on the account type.

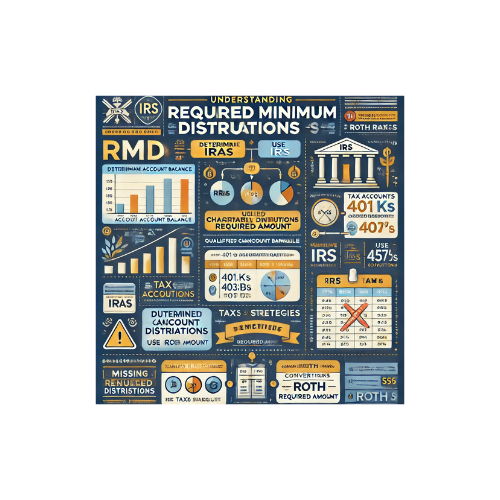

What Are RMDs and Why Are They Required?

RMDs are withdrawals that the IRS requires you to take annually from certain retirement accounts. They’re designed to ensure that tax-deferred savings are eventually taxed.

Which Accounts Are Subject to RMDs?

• Traditional IRAs

• 401(k)s, 403(b)s, and 457(b)s

• SEP IRAs and SIMPLE IRAs

Roth IRAs are exempt from RMDs during your lifetime, but Roth 401(k)s are subject to RMDs unless rolled into a Roth IRA.

How to Calculate and Take RMDs

Step 1: Determine Your Account Balances

- At the end of each calendar year, calculate the total balance of your RMD-eligible accounts.

Step 2: Use the IRS Uniform Lifetime Table

- Find your age on the IRS Uniform Lifetime Table to determine your distribution period factor. Divide your account balance by this factor to calculate your RMD.

Example:

• Account Balance: $500,000

• Distribution Period Factor (Age 73): 26.5

• RMD: $500,000 ÷ 26.5 = $18,868.

Step 3: Take the Withdrawal

- You can withdraw the RMD from one account or spread it across multiple accounts, depending on the account type (more on this below).

Do You Have to Take RMDs From Multiple Accounts?

It depends on the type of accounts you have:

Traditional IRAs

- You can aggregate RMDs from all your traditional IRAs and withdraw the total amount from one or multiple accounts.

401(k)s

- RMDs from 401(k) accounts cannot be aggregated. You must calculate and take the RMD from each 401(k) separately.

Strategies to Minimize Taxes on RMDs

1. Qualified Charitable Distributions (QCDs)

In my experience, QCDs are one of the most effective ways to reduce the tax impact of RMDs while supporting causes you care about.

• How It Works:

You can direct up to $100,000 per year from your IRA to a qualified charity. This amount counts toward your RMD but is excluded from your taxable income.

• Benefits:

• Reduces your taxable income.

• Satisfies your RMD obligation.

2. Strategically Time Roth Conversions

If you’re under age 73, consider converting a portion of your traditional IRA to a Roth IRA each year. This reduces your future RMDs since Roth IRAs are exempt.

3. Coordinate Withdrawals With Other Income

In my experience, retirees can often minimize taxes by timing their RMDs to avoid “stacking” taxable income in high-earning years.

When to Take RMDs

You must take your first RMD by April 1 of the year following the year you turn 73. However, delaying your first RMD means you’ll have to take two distributions in the same year, potentially increasing your tax liability.

FAQs About RMDs

1. What Happens if I Don’t Take My RMD?

- The IRS imposes a 50% penalty on the amount you failed to withdraw.

2. Can I Take More Than My RMD?

- Yes, you can withdraw more than your RMD, but only the required amount is subject to the mandatory distribution rules.

3. What’s the Best Way to Reduce the Tax Impact of RMDs?

- QCDs, Roth conversions, and careful timing of distributions can help minimize the tax impact.

Conclusion

RMDs are an unavoidable part of retirement planning, but with the right strategies, you can manage their impact on your taxes and overall financial plan. Whether it’s through QCDs, timing withdrawals, or exploring Roth conversions, thoughtful planning can make all the difference.

👉 Want to learn how to retire without the worry of running out of money in retirement? Click here to watch this video

Sources:

[1] https://www.bankrate.com/retirement/ira-rmd-table/

[2] https://www.tiaa.org/public/support/faqs/required-minimum-distributions

[3] https://www.schwab.com/ira/traditional-ira/withdrawal-rules/required-minimum-distributions

[4] https://www.missionsq.org/for-individuals/education/required-minimum-distributions

[7] https://www.fidelity.com/learning-center/personal-finance/retirement/required-minimum-distributions

[8] https://crsreports.congress.gov/product/pdf/IF/IF12750

Disclaimer: Case studies are hypothetical and do not relate to an actual client of Lock Wealth Management. Clients or potential clients should not interpret any part of the content as a guarantee of achieving similar results or satisfaction if they engage Lock Wealth Management for investment advisory services.