How to Build an Emergency Fund (And Why It’s Essential)

Why Emergency Funds Matter (And Why You Should Listen to Me)

Life is unpredictable. Whether it’s a car repair, medical bill, or unexpected job loss, financial emergencies can strike at any moment. An emergency fund is your financial safety net, providing peace of mind and protecting you from going into debt during tough times.

I’m Ben Loughery, CFP®, and I’ve worked with clients who’ve transformed their financial lives by building strong emergency funds. In my experience, this is the foundation of financial security. Without it, even the best financial plans can crumble under the weight of unexpected expenses.

This article will show you how to create an emergency fund step by step, explain why it’s essential, and share practical tips to get started—even if money is tight.

👉 Want to learn how to retire without the worry of running out of money in retirement? Click here to watch this video

What You’ll Learn in This Article

• Why emergency funds are critical for financial health.

• How much you should save.

• Strategies to build your fund quickly.

• Tools and tips to simplify the process.

By the end, you’ll have a roadmap to create your own financial safety net and secure your future.

Key Point: Why You Need an Emergency Fund

An emergency fund is like a fire extinguisher for your finances—you hope you never need it, but you’ll be grateful it’s there when disaster strikes.

Source: Emergency Fund

Without an emergency fund:

• You may rely on high-interest debt (e.g., credit cards).

• Financial stress can compound during crises.

• Long-term goals, like retirement savings, can be derailed.

With an emergency fund:

• You’re prepared to handle unexpected expenses.

• You avoid debt and maintain financial stability.

• You gain peace of mind, knowing you’re protected.

👉 Source: Emergency Fund, What It Is And Why It Matters

How Much Should You Save?

The size of your emergency fund depends on your unique circumstances.

General Rule of Thumb:

• 3–6 months of living expenses.

Factors to Consider:

1. Job Stability: If you have a stable job, aim for 3 months. If your income fluctuates, save 6 months or more.

2. Dependents: Families often need larger funds to account for unexpected expenses.

3. Health Risks: Medical emergencies can be costly, so consider saving more if you lack robust insurance.

How to Build an Emergency Fund Step-by-Step

Step 1: Assess Your Current Spending

Start by understanding how much you need to save. Review your monthly expenses, including:

• Housing costs (rent/mortgage, utilities).

• Transportation (car payments, gas, insurance).

• Groceries and essentials.

Step 2: Set a Realistic Goal

Break down your target fund into manageable steps. For example:

• If your goal is $10,000, aim to save $1,000 at a time.

In my experience, smaller goals are less overwhelming and help you build momentum.

Step 3: Automate Your Savings

Consistency is key. Set up automatic transfers to a separate savings account.

Pro Tip: Use a high-yield savings account to earn interest on your emergency fund.

👉 Source: Best High-Yield Savings Accounts – NerdWallet

Step 4: Cut Unnecessary Expenses

Small changes can add up quickly. Consider:

• Cancelling unused subscriptions.

• Cooking at home instead of eating out.

• Temporarily pausing non-essential purchases.

In my experience, clients who track their spending often find hidden opportunities to save.

Step 5: Find Extra Income Streams

Boost your savings with a side hustle or part-time gig. Ideas include:

• Freelancing or consulting.

• Selling unused items online.

• Driving for a rideshare service.

👉 Source: Best Side Hustles to Boost Income – Forbes

Common Challenges (And How to Overcome Them)

1. “I Don’t Have Enough Money to Save”

- Solution: Start small. Even saving $10 per week adds up over time.

2. “I Keep Dipping Into My Fund”

- Solution: Keep your emergency fund in a separate account, away from your main checking account.

3. “I Feel Overwhelmed by the Target Amount”

- Solution: Focus on your first $500. Once you hit that milestone, set your sights higher.

Tools to Simplify the Process

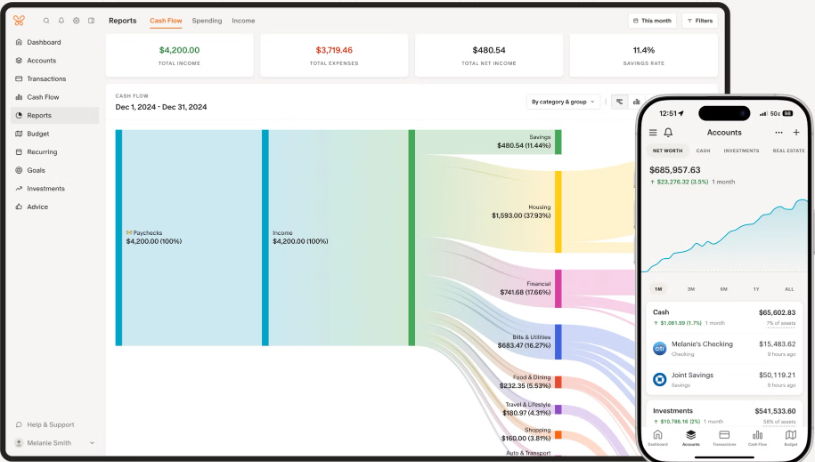

- Monarch Money

- Track spending and set savings goals in one app.

The Best Ways to Stay Motivated

1. Celebrate Small Wins: Reward yourself when you hit milestones.

2. Visualize Your Progress: Use charts or apps to track your growing fund.

3. Remember Your Why: Keep your long-term goals in mind to stay focused.

Conclusion: Your Financial Safety Net Starts Today

An emergency fund is one of the most important steps you can take to protect yourself financially. Whether you’re just starting out or looking to strengthen your safety net, the strategies in this article can help you get there.

In my experience, clients who prioritize building an emergency fund feel more confident and in control of their finances.

👉 Want to learn how to retire without the worry of running out of money in retirement? Click here to watch this video

FAQs

1. How Much Should I Save in My Emergency Fund?

- The general rule is 3–6 months of living expenses. Adjust based on your job stability and family needs.

2. Can I Use My Emergency Fund for Non-Emergencies?

- No. Your emergency fund should only be used for unexpected, urgent expenses like medical bills or job loss.

3. What’s the Best Account for an Emergency Fund?

- A high-yield savings account is ideal, as it keeps your funds accessible while earning interest.

Disclaimer: Case studies are hypothetical and do not relate to an actual client of Lock Wealth Management. Clients or potential clients should not interpret any part of the content as a guarantee of achieving similar results or satisfaction if they engage Lock Wealth Management for investment advisory services.