Fiduciary Financial Planning in Atlanta

Our comprehensive financial planning services include:

See our process & fees further

Tax Planning

- Personalized tax strategies using advanced software and reporting

- Strategic Roth conversions to manage future tax impact

- Required Minimum Distribution (RMD) optimization

- Charitable giving aligned with your values and tax goals

- Coordination with your CPA or tax preparer

Investment Planning

- Balancing growth and risk in line with your unique goals

- Transparent, low-cost portfolio design

- Professional investment management

Estate Planning

- Reviewing wills, trusts, powers of attorney, and beneficiary designations

- Planning for surviving spouses and heirs

- Minimizing tax impact on your legacy

- Ensuring your plan reflects your values and intentions

- Wealth.com Brochure

Insurance Planning

- Medicare guidance tailored to your specific situation

- Planning for out-of-pocket healthcare costs

- Bridging the gap to Medicare if retiring early

- Long-term care planning and additional insurance analysis

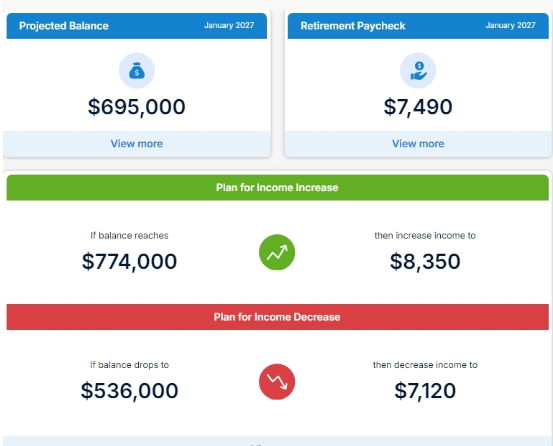

Income Planning

- Turning savings into dependable, lasting income

- Timing and strategy for Social Security

- Evaluating and optimizing pension choices

- Creating a tax-smart withdrawal plan

This example from our income planning software shows how we monitor your portfolio and income within clear, flexible “guardrails”—so you know when to safely adjust income as markets shift. Ready to book a call? Schedule here