Budgeting 101: How to Take Control of Your Monthly Finances

Why Learning to Budget is Life-Changing (And Why You Should Listen to Me)

Budgeting is often seen as restrictive or complicated, but I believe it’s one of the most empowering financial tools available. By creating a clear plan for your money, you gain control, reduce stress, and make progress toward your biggest financial goals.

I’m Ben Loughery, CFP®, and I’ve worked with individuals and families at every stage of life. In my experience, budgeting isn’t about depriving yourself; it’s about creating freedom. A good budget aligns your spending with your values, helping you build wealth while still enjoying your life.

In this guide, I’ll walk you through practical, step-by-step strategies to take control of your monthly finances, avoid common pitfalls, and feel confident about your money.

👉 How would it feel to know exactly when you can retire and how much you can spend without running out of money? Let’s talk. In a complimentary call, I’ll walk you through your numbers and show you strategies that could help you retire with more confidence and less stress. Schedule Your Call

What You’ll Learn in This Article

- Why budgeting is critical for financial success.

- How to create a monthly budget that works for you.

- Tools and strategies to simplify the process.

- Real-life examples to inspire you.

By the end, you’ll have the knowledge to take control of your finances and start making progress toward your financial goals.

The Big 5 Reasons You Need a Budget

- Clarity: Understand exactly where your money is going.

- Control: Take charge of your financial future.

- Confidence: Reduce stress and make better decisions.

- Goal Achievement: Allocate funds toward what matters most.

- Freedom: Spend guilt-free within your limits.

In my experience, clients who embrace budgeting feel empowered rather than restricted; it’s about saying yes to the things that matter and no to what doesn’t.

How to Get Started with Budgeting

Step 1: Understand Your Current Financial Picture

Before you create a budget, you need to know where your money is going. I recommend:

- Reviewing bank and credit card statements for the past 3 months.

- Categorizing expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment).

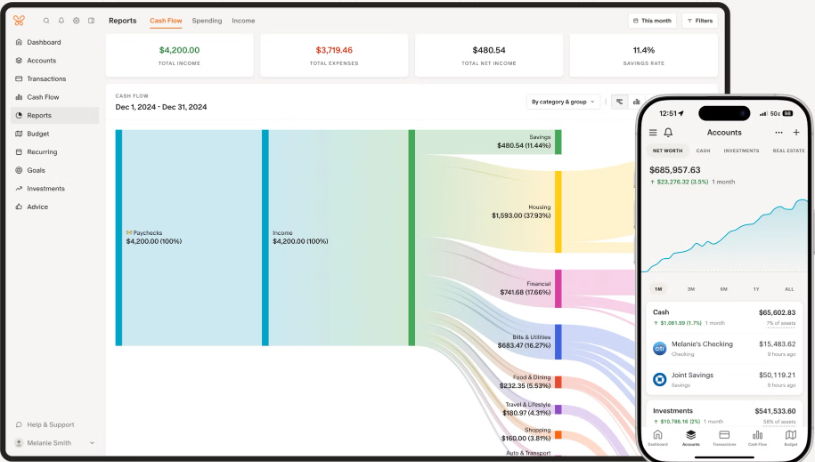

Tool Suggestion: Use apps like Monarch Money to track and categorize spending automatically.

Step 2: Set Clear Financial Goals

A budget without goals is like a map without a destination. Decide what you’re working toward, whether it’s:

• Building an emergency fund.

• Paying off debt.

• Saving for a down payment.

Step 3: Choose a Budgeting Method

Not all budgets are created equal. Here are three popular approaches:

The 50/30/20 Rule

• 50% of income for needs.

• 30% for wants.

• 20% for savings and debt repayment.

Pros: Simple and flexible.

Cons: May not work if your expenses are already tight.

Zero-Based Budgeting

Every dollar is assigned a job, from groceries to savings.

- Pros: Maximizes efficiency.

- Cons: Requires more effort to track spending.

Envelope System

Use physical or digital envelopes for spending categories.

- Pros: Keeps spending in check.

- Cons: Less practical in a cashless world.

Common Budgeting Pitfalls (And How to Avoid Them)

1. Unrealistic Expectations

Budgeting doesn’t mean cutting out all fun. In my experience, budgets that are too restrictive often fail.

- Solution: Allocate funds for things you enjoy to make your plan sustainable.

2. Not Accounting for Irregular Expenses

Big, irregular expenses (like holidays or car repairs) can derail your budget.

- Solution: Set up a sinking fund—a small monthly amount saved for future expenses.

3. Overlooking Automation

Manual budgeting can be time-consuming and lead to burnout.

- Solution: Automate your savings and bill payments to streamline the process.

Tools to Simplify Budgeting

Monarch Money

Track expenses, categorize spending, and visualize your budget.

The Best Way to Stay on Track

Consistency is key. Here’s how to make budgeting stick:

• Schedule Weekly Check-Ins: Review spending and adjust as needed.

• Celebrate Small Wins: Every debt paid off or milestone reached deserves recognition.

• Involve Your Family: Budgeting as a team creates accountability and shared success.

In my experience, clients who track progress regularly are far more likely to stick with their budgets.

Budgeting is a powerful tool that can transform financial lives, providing clarity, control, and confidence. Here are a few real-life case studies illustrating how effective budgeting has led to financial success:

Case Study 1: From Debt to Financial Freedom

Sarah and Mark found themselves overwhelmed by credit card debt and struggling to make ends meet. By implementing a strict budget, they tracked every expense, cut unnecessary spending, and allocated funds toward debt repayment. Over time, they paid off their debts and built a substantial savings cushion, achieving financial freedom.

Key Strategies:

• Expense Tracking: Monitoring all expenditures to identify and eliminate unnecessary costs.

• Debt Prioritization: Focusing on paying off high-interest debts first.

• Consistent Budgeting: Regularly reviewing and adjusting the budget to stay on track.

Case Study 2: Achieving Financial Goals Through Budgeting

Chari and Martell, a couple with differing financial backgrounds, struggled to align their spending habits. They initiated annual budget retreats to set clear financial goals and create a unified spending plan. This practice led them to achieve multiple financial milestones, including debt repayment and savings accumulation.

Key Strategies:

• Annual Budget Retreats: Dedicated time to discuss and plan financial goals.

• Goal Setting: Establishing clear, achievable financial objectives.

• Collaborative Budgeting: Working together to create and adhere to a budget.

Case Study 3: Overcoming Financial Hardship with Budgeting

Kyle faced nearly $20,000 in debt, causing significant financial stress. By starting a budget and setting specific goals, she saved $1,500 in the first month and progressively paid off her debts. Budgeting provided her with a clear plan and the motivation to regain control over her finances.

Key Strategies:

• Specific Goal Setting: Defining clear financial targets to work toward.

• Incremental Progress: Celebrating small victories to maintain motivation.

• Budget Discipline: Adhering strictly to the budget to achieve financial goals.

Behavioral Finance Books to Enhance Budgeting Skills

Understanding the psychological aspects of financial decision-making can further enhance budgeting effectiveness. Here are some recommended books:• “The Psychology of Money” by Morgan Housel: Explores the behavioral aspects of finance, highlighting how emotions and mindsets influence financial decisions and success.

Source: Psychology of Money

• “Thinking, Fast and Slow” by Daniel Kahneman: Examines the dual systems that drive the way we think, offering insights into cognitive biases affecting financial decisions.

These resources delve into the psychological factors influencing financial behaviors, offering strategies to make more rational and effective budgeting decisions.

Individuals who commit to a structured budgeting plan and seek to understand the behavioral aspects of financial decision-making are more likely to achieve their financial goals and maintain long-term financial health.

Here is an article I contributed to recently on budgeting with a $50,000 salary

Conclusion: Take Charge of Your Financial Future

Budgeting isn’t about restriction—it’s about creating the freedom to spend on what matters most. By following the steps outlined in this guide, you’ll gain clarity, confidence, and control over your money.

Remember, the hardest part is starting—but once you do, you’ll wonder how you ever managed without a plan.

👉How would it feel to know exactly when you can retire and how much you can spend without running out of money? Kind of crazy that you just found this blog… and your next step might be booking a complimentary call. In that call, we’ll explore your numbers and see what’s truly possible for you. Schedule Your Call

FAQs

1. Do I need to budget if I’m already saving money?

- Yes! A budget ensures you’re saving efficiently and spending in alignment with your goals.

2. What’s the best way to stick to a budget?

- Automate your savings and check in with your progress weekly.

3. What if my income fluctuates?

- Base your budget on your lowest monthly income and adjust for higher-earning months.

**GoBankingRates article on saving more even if you earn a high salary already

** This is an article in FinancialAdvisor Magazine discussing how our own country treats it's finances like a business

**Article from the Daily Mail on Trump Tariffs and the effect its has regarding spending

**MSN quoted me about how retirees can navigate tariffs in 2025

Disclaimer: Case studies are hypothetical and do not relate to an actual client of Lock Wealth Management. Clients or potential clients should not interpret any part of the content as a guarantee of achieving similar results or satisfaction if they engage Lock Wealth Management for investment advisory services.